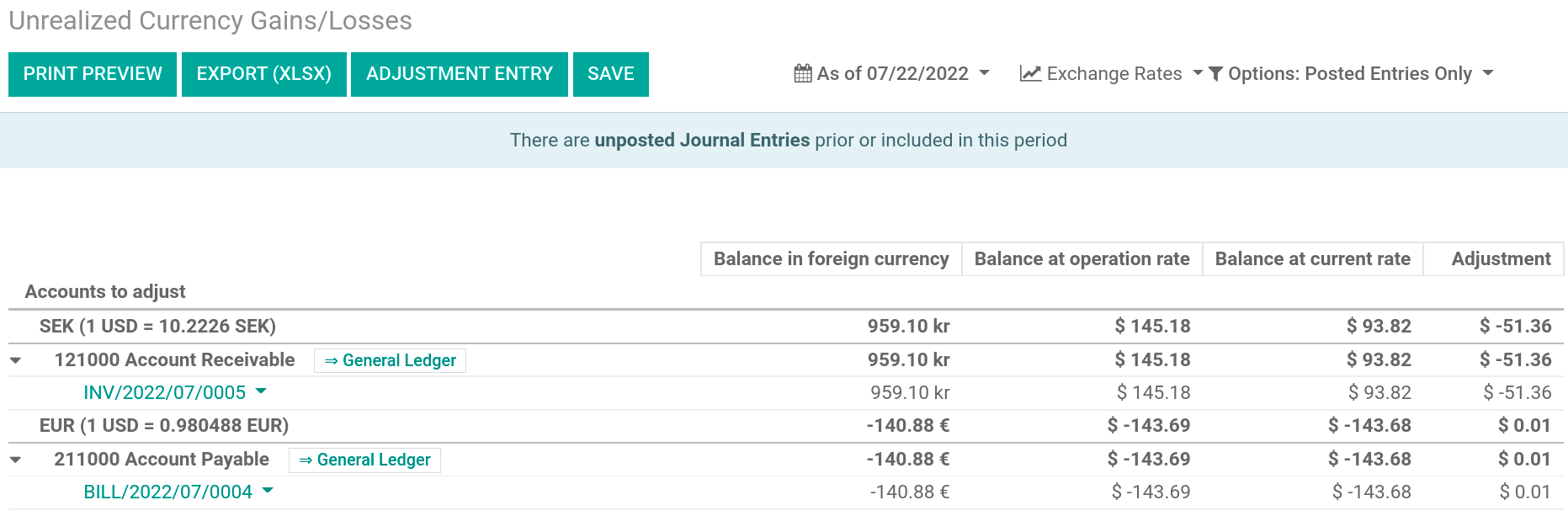

What is the journal entry to record a foreign exchange transaction

4.9 (780) · $ 12.00 · In stock

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Manage a bank account in a foreign currency — Odoo 17.0 documentation

Accounting Journal Entries for Foreign Exchange Gains and Losses

Journal Entries in Accounting with Examples - GeeksforGeeks

Entering and Processing Foreign Currency Journal Entries

Accounting for Bills of Exchange

Hedges of Recognized Foreign Currency–Denominated Assets and Liabilities - The CPA Journal

Foreign Currency Transaction & their Journal Entry

Advance Acctg Foreign Currency Problems, PDF, Exchange Rate

Payment Entry

Foreign currency invoices and bills – Help Center