Tax Brackets in the US: Examples, Pros, and Cons

4.6 (526) · $ 19.50 · In stock

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

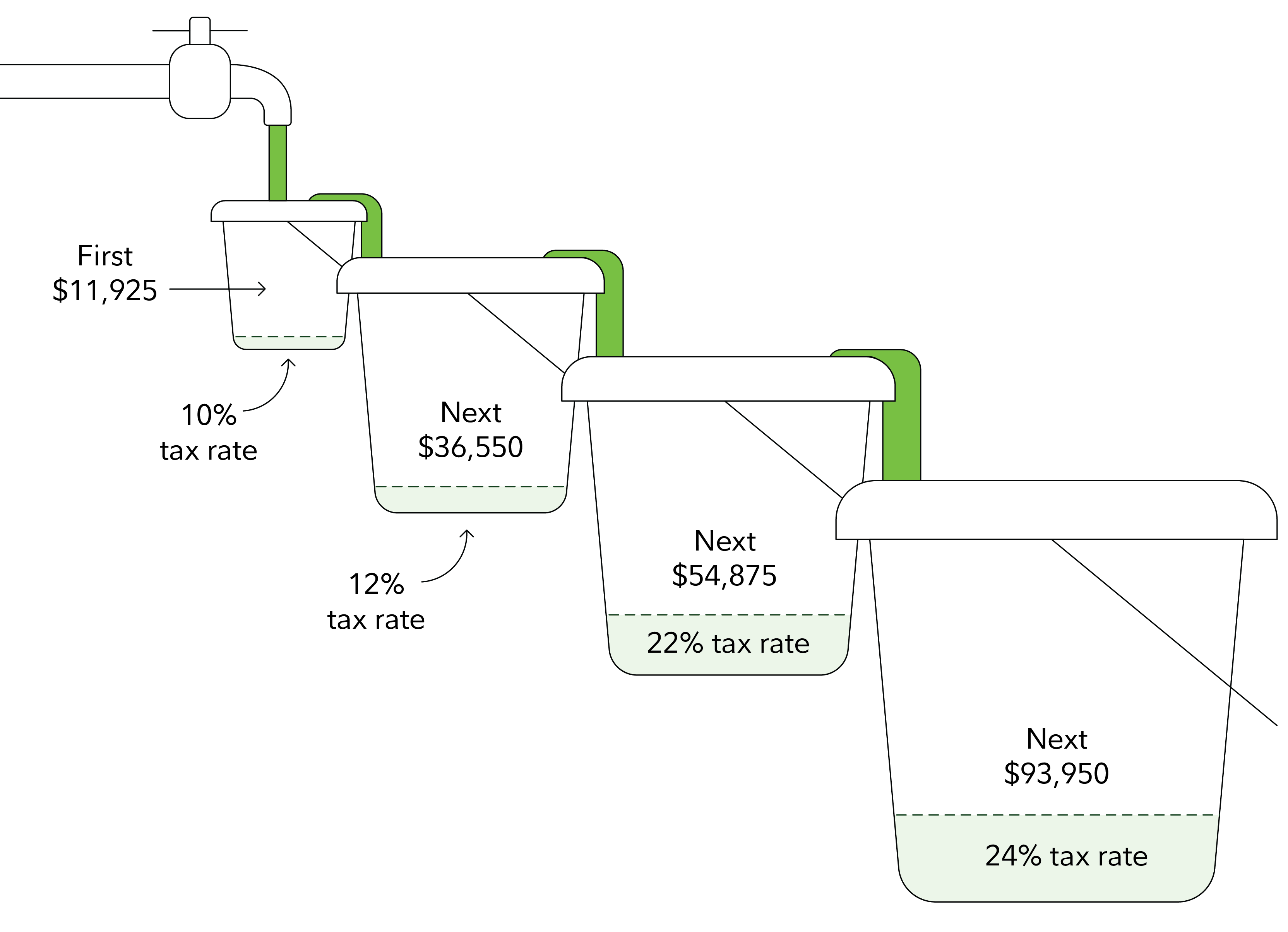

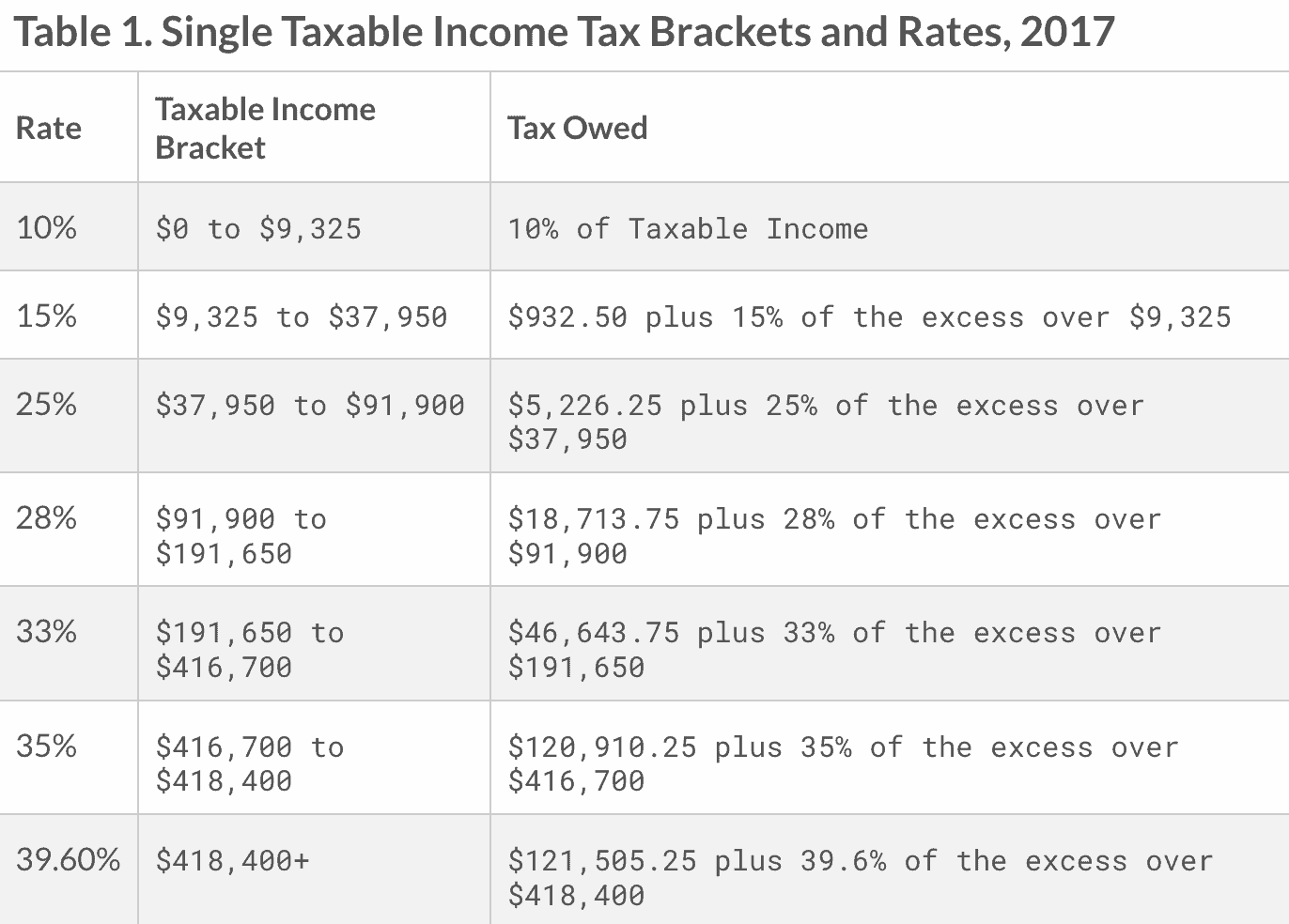

A tax bracket is a range of incomes subject to a certain income tax rate.

How do tax brackets work?, How do taxes work?

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

Canada vs. U.S. Tax Rates: Do Canadians Pay More?

:max_bytes(150000):strip_icc()/GettyImages-1143762486-f3c5dccd66e9432ea3536961740a8416.jpg)

State Income Tax vs. Federal Income Tax: What's the Difference?

:max_bytes(150000):strip_icc()/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)

Tax Liability: Definition, Calculation, and Example

Salary vs dividend - which is now best for business owners?

![Premium pricing strategy: Pros & cons [+ examples]](https://images.prismic.io/paddle/6b0f5112-e34f-4594-9cc2-c5b3f1f4a84e_economy-pricing-pros-cons.png?auto=format,compress)

Premium pricing strategy: Pros & cons [+ examples]

Difference between Direct and Indirect Tax: Advantages & Disadvantages

:max_bytes(150000):strip_icc()/payrolltax.asp_final-f09aa1c3011c44ba925ae501bd4785ad.jpg)

Taxes Definition: Types, Who Pays, and Why

Pros and Cons of Running Multiple Businesses Under One Limited

:max_bytes(150000):strip_icc()/GettyImages-CA21828-6efa3d1061f04e47b23487ce9917a985.jpg)

Taxes Definition: Types, Who Pays, and Why

:max_bytes(150000):strip_icc()/550437717-56a9392b5f9b58b7d0f961d7.jpg)

Withholding Tax Explained: Types and How It's Calculated

Start Planning Now For A Higher Tax Environment Pay Taxes, 42% OFF